Some might look at recent Central Florida single family home sales numbers and wonder if the market has peaked as sales have slacked off a bit, but let’s not jump to conclusions just yet. This week we take you inside the numbers and explain what’s happening and what we’re keeping our eyes on.

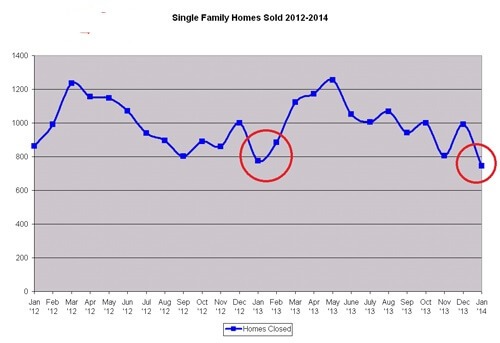

As you can see from the Homes Sold graph, sales are down. This is somewhat expected as inventory is down and agents have been selling more new construction to satisfy home buyer’s needs. 2013 sales numbers dipped in January but rebounded nicely going into season leading up to a fantastic May. This could happen again this year.

Should sellers beware? Maybe. While you can definitely see the seasonality of home sales, there is no doubt the rising home sale prices will limit buyers, as will rising interest rates. Rates are expected to rise even more in 2014.

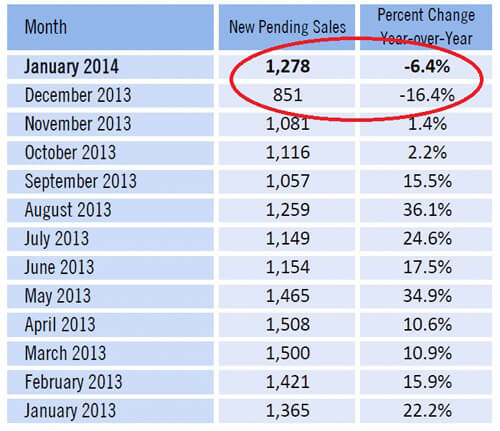

We also looked at pending sales in December 2013 and January 2014 as this is an indicator of potential future closings in the coming months. Pending sales were down 16.4% year over year in December, and down 6.4% in January. Again, this is a short time frame to look at, and some of this could be attributed to limited inventory, however it could impact reported closings going forward.

We really want to look at how February sales come in which won’t be reported for another 3 weeks or so. Prices will probably be higher and sales could be lower than last year. January thru May sales set the trend for all year, so we’re keeping a close eye on trends these first few months.

Yes, we’ll probably have rising prices. Prices rose again in January to a $180,000 median price and a mean average of $301,035. That’s up roughly 25% or better for both numbers over last year.

Are rising prices limiting sales? Is limited inventory holding back sales? Is new construction competing with existing home sales again? Are rising interest rates limiting sales? Nobody knows the answers yet. We’ve identified some indicators to watch though.

If you’re a seller, you might want to look at how well your home competes against other similar homes on the market. If you have a $ 1 Million+ home there is currently about a 3 yr supply of homes on the market, so you have to look at what you need to do to sell your home versus waiting 3 years. And what if the market falls within 3 years or more listings come to the market? It could take even longer to sell at reduced prices.

If your home is in the $400-600,000 range, there is about a 1 year supply of homes. Again, it pays to know your competition and price accordingly. Our market has been doing well the past few years. 2014 looks to be another good year, but don’t take price gains for granted. There is no law that says prices will rise forever. New construction is now competing against you again for the first time in years. Central Florida may return to a more moderate market, which is probably best anyway.

We’ll keep tracking the trends, and as always, if you need assistance buying or selling in Central Florida, Always Call The Realty Medics Team. 321-947-7653 or www.TheRealtyMedics.com

Good luck and happy buying/selling!