Investment Property Tax Paperwork, Yes Even in Florida

Forget New Year’s Eve. Now is the time for annual reflections on the fiscal year gone by. As any business owner will tell you, REAL New Year’s Resolutions come after meticulously pouring over recorded statements, receipts and ledgers. Let the reckoning of last year’s taxes begin.

Much like the numbers on the scale for a dieter, your business accounting measures just how successful you were overall during the previous calendar year and where you need to focus your efforts moving forward. If you own rental properties, this is also the time to determine your actual return on investment (ROI) and if it’s meeting your financial goals.

Is Rental Income Taxed in Florida?

Florida has long been a desirable state for real estate investors for a variety of reasons from sunny beaches to booming economies. Owners of property in the Sunshine State are comparatively lucky with state property tax rates that are well below the national average and the absence of state individual income taxes. However, any net profit generated from renting (or selling) investment property will still be taxed federally.

The effort to pull together your documentation doesn’t have to be arduous. In fact, as your property management team, we’re here to make things easier during tax time!

In-House Subject Matter Experts

The Realty Medics are very familiar with the information you will need for the IRS in addition to the standard 1099 forms. We keep detailed accounting records and documentation on everything surrounding your property portfolio. For example, the full online account system allows you to quickly and easily generate summary profit and loss statements for tax purposes. And you have 24/7 access to your files via the owner portal login system.

The Importance of a Florida Tax Specialist

This brings us to an important point: we are not tax or legal professionals so when it’s tax season, you’ll need to call in the big guns to complete your paperwork for the IRS. You need someone who understands all the intricacies of the ever-changing tax laws, tailored for your individual income and tax scenario.

As a real estate investor in Florida, particularly if you do not reside in the state, it is vital you hire a tax or legal professional who specializes in Florida investment property taxes. They’ll be able to advise you throughout the year on business deals and quarterly tax payments in addition to finalizing your annual tax returns. The tax-adverse will appreciate someone who can expertly determine the minimum amount you’ll need to pay in taxes that keep you in compliance with the IRS while avoiding hefty fees. For example, even though you’re not paying individual income taxes in Florida, you still need to submit the proper paperwork.

If you need help finding an accountant or tax attorney you can trust, let us know! We have vetted and regularly work with many reputable specialists that we can recommend for your specific needs. Call us at 321-947-7653 or fill out our contact us online for more information.

The Realty Medics. Engineering Property Management Peace of Mind.

LEARN MORE WITH OUR VIDEOS

FOLLOW US ON FACEBOOK

If you want to experience Rocket Science Renting for yourself, The Realty Medics offers the lowest property management rates in Orlando. Contact us today to find out what your home will rent for by calling 321-947-7653 or filling out a FREE Rental Price Analysis.

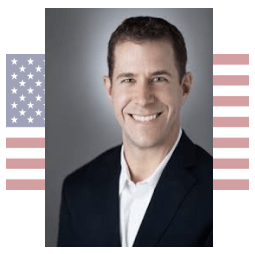

Ben Sencenbaugh is a former NASA engineer who heads The Realty Medics, Central Florida’s #1 residential property management company. A loyal Orlando resident since buying his first rental home in 1997, Ben brings rocket science to renting, applying advanced technology to make renting single-family homes a better, simpler and more successful experience for owners and tenants.