Foreign Investors Buying Real Estate in The Central Florida area

The Realty Medics has a long history of advising International property investors on their acquisition of real estate in the Central Florida area. From our office in Orlando, we can provide every level of support to private clients, corporations, as well as real estate funds for their real estate investments. We will match investment opportunities in residential real estate in all market conditions – through our extensive database, our knowledge of market trends, property values, and our network.

The Realty Medics will not only identify and analyze each investment property for you to purchase, but after you close on the property, we can perform the rehab and repairs. We will also find you a qualified tenant, manage the property on your behalf, and handle the day-to-day administration, leasing, maintenance, and reporting.

Whether you are looking for an investment property or relocating to Florida, our specialized buyer services make the process stress-free and rewarding. We provide independent information, expert advice, and comprehensive knowledge to help you make the best decision and secure the ideal property that best suits your expectations and needs.

Florida real estate is popular among international property investors due to its location, home prices, rental rates, transparency, and capital appreciation. If you are an international property investor with immediate questions about buying Central Florida real estate, please contact us or call 321-947-SOLD (7653).

What International Property Investors Should Know When Buying Property in the U.S.

Unless a tax treaty exists between the U.S. and a specific country, international property investors, including estates, corporations, nonresident aliens, and partnerships, pay a flat 30 percent withholding tax on the rents produced by their U.S. real estate investments. This tax applies unless foreigners’ investments are connected with a U.S. trade or business or the foreign owner has made an election with the Internal Revenue Service to be taxed on a net basis. (Having rental income taxed on a net basis after deductions for costs or operations, maintenance, and carrying charges usually results in a lower overall tax for the foreign owner.)

This 30-percent withholding tax is calculated on the gross amount of the rents generated by the property without allowable deductions for interest, depreciation, repairs, management and association fees, insurance, real estate taxes, or other expenses of owning and operating the property.

Avoiding the Withholding Tax: Foreign Owners

Because of this potential tax liability, The Realty Medics request that the foreign investor’s apply for the Individual Tax Payer Identification Number or ITIN W-7 Form. Once this number has been provided to The Realty Medics we can disperse the funds without any withholding’s. This will save you approximately 30%.

W-8ECI Form. Nonresident aliens and other foreign Investors must complete the Form W-8ECI, which certifies a foreign person Income Is Effectively Connected With the Conduct of a Trade or Business in the United States. (Real Estate).

The Realty Medics will collect the rent from the tenants, pay the maintenance, HOA and related costs with the rental income, and we will remits the balance to the owner. We are very familiar with the International Investment laws. Please Contact Us with any questions.

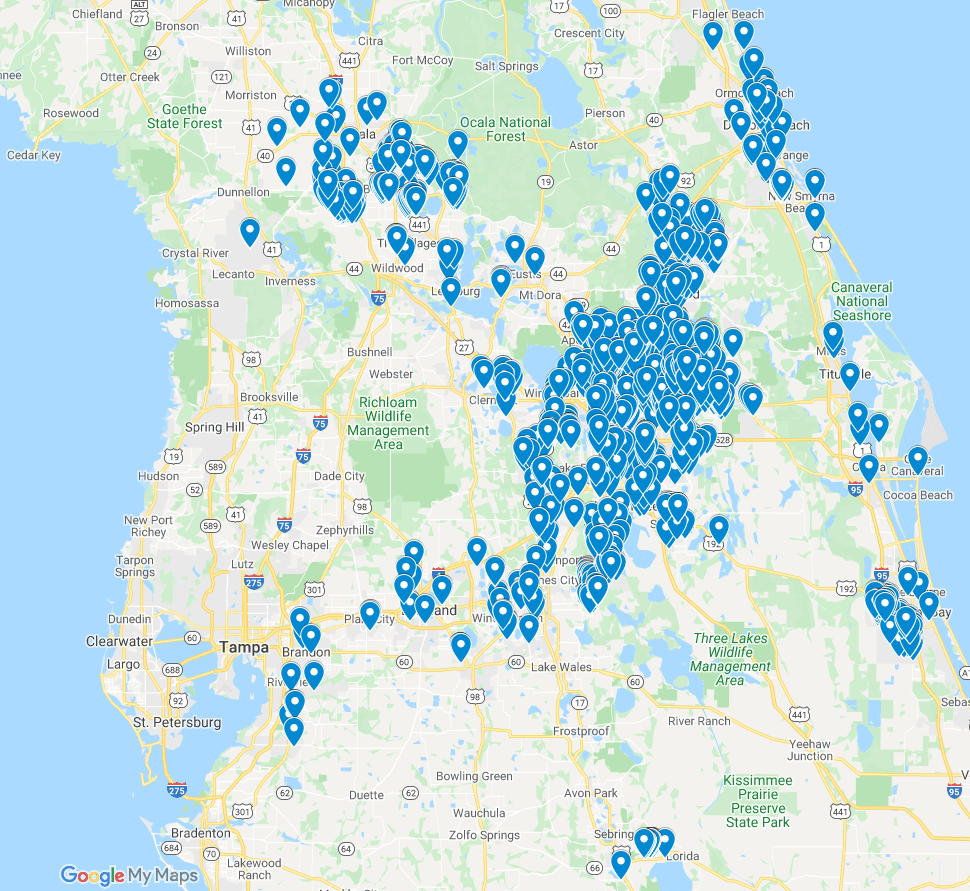

Areas We Serve in Florida

We’re happy to serve many of the surrounding areas here in Central Florida. Below are the current cities and locations that we operate in. If you don’t see your area listed, don’t hesitate to reach out to us and we’ll see if we can work together.

Ready to Get Started?

Please fill out the form above and somebody from our team will be in contact with you as soon as possible. We’d be happy to discuss your needs to know how to best serve you.